|

Excerpt

from the Soroptimist Magazine September/October/November 2002 –

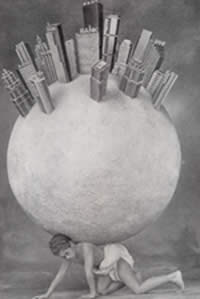

A MATTER OF LIFE AND DEBT |

As third world countries struggle to pay back international debt, poor women and children suffer. by Marielena Zuniga |

||

|

Josephine

from Kenya was 4 years old when she became ill. At a health clinic,

Josephine’s mother was told she would need to buy a penicillin

ointment for her daughter’s eyes. But Kenya had already drastically

cut support of health care because of its debt burden to wealthier nations.

Already poor, Josephine’s mother had to make a life-changing decision

in a split second. Did her daughter receive medical care or did her

family eat? Today, Josephine Sinyo, a member of Kenyan Parliament, is

blind.

The explanation is morally disturbing. Impoverished countries are spending more-in some cases three to five times more-in repayment of their debt to wealthier nations instead of investing in their own economic development, health, education, infrastructure or industry. “Women must figure out how to manage the family’s budget, how they can feed their family, how they can provide for health care, as in the case of Josephine Sinyo, who is now blind,” Njehu says. “Can you imagine being a mother and having to make that decision? These are the life-and-death decisions women are having to make every day due to debt servicing.” History of the Debt Crisis The crisis began in the 1970s when many oil-exporting countries had large amounts of extra money that they deposited into Western banks to earn interest. Flush with funds, these banks then loaned this money at very low interest rates to Third World countries for major development projects. The banks and governments of Europe, Japan and the United States did not look very closely at how the money was being used and assumed the loans would be repaid. But military governments, particularly eager to borrow, failed to use the money for socially responsible programs. Widespread corruption did nothing to slow lending, however. In the 1980s, a recession hit the industrialized world and interest rates soared, including rates on loans to the Third World. At the same time, Third World countries were earning less money from their exports and the retail price of goods and materials went down. Many countries found it difficult to pay even the interest on their debts, never mind the original principal. Poorer nations had to continue borrowing money just to repay the interest. The debt grew. Today, the Third World as a whole wobbles under the weight of a $2.3 trillion debt owed to the world’s wealthiest nations, including the U.S., Britain, Japan, France and Germany. Other important creditors include the large international financial institutions like the International Monetary Fund (IMF) and the World Bank (WB), which are controlled primarily by the world’s wealthiest nations. Regional development banks and commercial banks also have outstanding loans to poor nations. While these poor countries have paid the principal many times over, the debt remains because of increases in original interest rates and rescheduling arrangements. In the 42 countries defined by the WB as Heavily Indebted Poor Countries (HIPC), 700 million people live on an average of $4 a day. Many survive on less than $1 a day. Yet these countries are expected to repay more than $220 billion in loans. |

Sapping

the Poor

In Bolivia, for example, fees for water have risen drastically, sometimes by 30 percent, says Marie Clarke, national coordinator of the Washington, DC-based Jubilee USA Network, a coalition dedicated to debt cancellation. With increased unemployment comes increased domestic violence, a breakdown in the family unit, and women forced into prostitution in order to survive, hastening the spread of AIDS. The

Debt Trap Deepens |

|

|

|

Surviving

Debt

“In my home village in Kenya, the people are working hard to build a clinic … they are pooling their meager resources,” says Njehu of 50 Years Is Enough. “What they are looking for from the G8 (the world’s eight most powerful industrialized nations) and other world nations is the support they need to succeed and the political success to pursue their dreams.” Women, in particular, are making a difference. In Africa, one of the areas hardest hit by debt servicing, they are calling for an end to SAPS and for the development of economic policies that reflect their needs and priorities. A recent article in The New York Times touched Njehu, who believes it should prompt everyone to ask some disturbing questions. In a remote village in Kenya, the Maasai people had heard of the September 11th disaster. Already poor, they donated 14 cows-their wealth-to help those suffering in America. “What does this say about the Maasai people,” she questions, “… and what does that say about this country and other wealthy nations that they are willing to allow kids to continue to die and let mothers bury their children too young because they couldn’t afford 30 cents of malaria medication? What does this say?” Dropping

the Debt |

Clarke

believes that if the wealthiest countries have the political will to

cancel the debt, it will happen. She states, “It’s time for

people of faith to call on the Biblical Jubilee principle* for people

of conscience to stand up and say enough is enough, this needs to change.”

*According to the New Testament book of Leviticus, during the Jubilee those enslaved because of debts are freed, lands lost because of debt are returned, and community torn by inequality is restored. Taking Action · Supporting women in debt-heavy areas with the Women¹s Opportunity Awards program helps encourage and promote economic development. Clubs can also apply for and implement Making a Difference for Women grants that encourage microenterprises in developing countries. · Support Project Five-O, which was adopted by Soroptimist International in 1980 and focuses on providing vocational training and employment for women in developing countries and countries in transition, with the goal of alleviating poverty and advancing the status of women. · Urge local and national governments to authorize and appropriate critically needed funding for debt relief for impoverished countries by holding letter-writing campaigns. In the U.S., contact senators and representatives to approve $810 million over the next three years to fulfill U.S. debt-relief commitments made at the G8 Economic Summit in Cologne, Germany. For a general form letter urging government officials to help solve the debt relief crisis, go to the Lutheran Office on Government Affairs <www.loga.org>. · Link up with members of Jubilee 2000, an international organization devoted to providing debt relief for the world¹s poorest nations, <www.jubilee2000.org>. · Raise awareness about debt relief in local communities. Encourage citizens to endorse the urgent need for debt cancellation. Several organizations campaigning for debt relief have background information on the debt crisis and resources-including the World Development Movement <www.wdm.org.uk>, and OxFam <www.oxfamamerica.org>-which help make the issue of debt relief accessible to others. You can read the full article by visiting: http://www.soroptimist.org. Click on Magazine, Magazine Feature Article, Sept/Oct/Nov2002  |

|

|

SI Sequim |